Robo-advisors are becoming a go-to solution for individuals looking for an accessible way to grow their wealth. These automated platforms use algorithms to design a personalized investment portfolio based on your financial situation.

With robo-advisors, you can automatically invest in a diverse mixture of investments, such as shares, bonds, and property.

- Advantages of using a robo-advisor encompass:

- Competitive pricing

- Passive approach

- Financial goal alignment

- User-friendly interface

Digital Financial Planners: A Beginner's Guide to Automated Investing

Are you new to the world of investing? Do you desire to grow your wealth but feel intimidated by traditional investment strategies? Robo-advisors may be the perfect answer for you. These automated platforms utilize algorithms and digital technology to manage your investments based on your risk tolerance.

A robo-advisor will inquire you about your capital allocation, then construct a personalized portfolio containing a varied mix of investments. This asset allocation helps to minimize risk and hopefully enhance your returns over time.

- Advantages of using a Robo-Advisor:

- Affordability

- Ease of Use

- Openness

Robo-advisors financial freedom with automated investing provide a seamless investing process, making it easier for everyone to invest in the financial markets. Whether you're a first-time trader or a seasoned individual, robo-advisors can be a valuable asset to help you achieve your financial goals.

Trading Easy with Robo-Advisors

Are you looking to simplify his or her investment journey? Robo-advisors offer a powerful solution by handling the task of creating and monitoring a diversified fund. These advanced platforms use technology to analyze your investment goals and design a personalized plan that fits their objectives.

- Advantages of Robo-Advisors:

- Low fees compared to traditional managers

- Ease of Use for individuals

- Portfolio Optimization to reduce risk

Embark your wealth-building process today with the simplicity of a robo-advisor.

Begin Your Investing Journey with Robo-Advisors: A Step-by-Step Guide

Stepping into the world of investing can feel daunting, but robo-advisors offer a streamlined approach to building your wealth. These automated platforms handle your investments based on your financial situation. Prepared to get started? Here's a step-by-step guide to employing robo-advisors effectively:

- Identify a Robo-Advisor: Research different platforms and contrast their fees, investment strategies, and features. Consider your preferences.

- Create an Account: Provide essential information like your name, address, and Social Security number. You'll also have to link your bank account.

- Submit a Risk Assessment: Answer questions about your investment knowledge, time horizon, and comfort level with market fluctuations. This helps the robo-advisor establish your suitable investment portfolio.

- Contribute Your Account: Transfer money from your bank account to your robo-advisor platform. Start small and augment your contributions over time.

- Track Your Portfolio: Regularly check the performance of your investments and adjust your asset allocation as required. Keep in mind that investing is a long-term {strategy|approach|plan>.

Streamlined Investing: The Power of Robo-Advisors

In today's fast-paced world, finding the time and expertise to navigate the complexities of investing can be a challenge. That's where robo-advisors come in. These digital platforms leverage cutting-edge technology to manage your investments, providing a efficient way to grow your wealth. Robo-advisors typically evaluate your financial goals and create a diversified portfolio tailored to your needs. They then continuously monitor your investments, reallocating them as market conditions change. This hands-off approach allows you to focus your time and energy to other priorities, while knowing that your investments are being professionally managed.

- Additionally, robo-advisors often come with low expenses, making them an budget-friendly option for investors of all capacities

- Ultimately, robo-advisors can be a powerful tool for anyone looking to streamline the investing process and achieve their long-term aspirations.

Discover the World of Passive Income Through Robo-Advisors

Are you dreaming about financial freedom and extra spending money? A robo-advisor could be your ticket to achieving passive income. These intelligent platforms handle your investments with minimal human assistance, allowing you to relax and watch your portfolio grow.

A robo-advisor journey typically begins by answering a short questionnaire about your risk tolerance. Based on your answers, the platform constructs a tailored portfolio of investments that aligns with your aspirations.

- Periodically rebalancing ensures your portfolio stays on track, while accountability gives you a clear picture of your investments' growth.

Whether|your financial knowledge is limited, a robo-advisor can be an excellent tool for creating passive income. So consider this pathway and embark your journey toward financial freedom today?

Haley Joel Osment Then & Now!

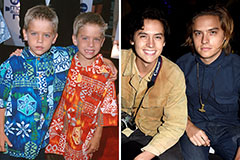

Haley Joel Osment Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! David Faustino Then & Now!

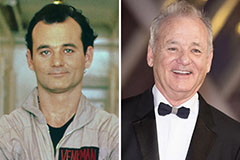

David Faustino Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!